Bank of England Governor Andrey Bailey exerted pressure on the British currency on Wednesday, although he did not announce anything new or particularly groundbreaking – he simply reiterated the previously voiced thesis that the interest rate should remain at the current level. He has repeated this idea several times, unlike some of his colleagues who not long ago surprised the market with their hawkish remarks. Bailey essentially refuted the hawkish intentions of the central bank: according to him, the current rate is "working," and in determining the further prospects, the central bank will consider the cumulative extent of monetary tightening and the lagging effects of monetary policy. In addition, Bailey mentioned the side effects of tight monetary policy and the risks to financial stability that may arise in the foreseeable future (here he expressed concern about the state of the Chinese economy – according to him, this is a "key uncertainty").

In other words, Bailey suggested that he would follow the medical principle of "do no harm," especially since the current rate is effective, as evidenced by the recent UK inflation reports.

To recap, the Consumer Price Index (CPI) sharply decreased on a monthly basis to zero. On an annual basis, the indicator also entered the "red zone," reaching 4.6% (the forecast was at 4.8%) – the slowest growth rate since October 2021. The core CPI in October dropped to 5.7% – the weakest growth rate since March 2022. The retail price index, used by British employers in wage contract negotiation, also slowed down. On a monthly basis, it showed a negative value (-0.2% MoM) against a forecast of growth to 0.1% MoM, and on an annual basis, it dropped to 6.1% YoY, against a forecast of growth to 6.3%.

This report was published in mid-November, and essentially, it put an end to the sluggish debate about the need for another rate hike.

However, some members of the BoE continued to voice hawkish rhetoric, suggesting another round of rate hikes. In particular, Jonathan Haskell stated that the decline in the CPI "cannot be a reliable guide for determining inflationary trends." According to him, inflation remains at too high a level, and this fact "cannot fail to be of concern." His colleague, Catherine Mann said that there have been signs of sustained inflation lately, indicating the need for additional monetary tightening. Deputy Governor Dave Ramsden also suggested a rate hike, noting that recent household and business surveys indicate that inflation expectations are stable.

Given the declining dynamics of key inflation indicators, such comments seemed somewhat illogical. However, it is important to note that these statements were made within the walls of the British Parliament's Lower House, so political motives cannot be ruled out in this case. The BoE showed that it is ready to act decisively – if necessary, it will use the necessary tools to curb inflation. By the way, Bailey was quite restrained in his assessments at that meeting. He suggested that the interest rate is at its peak, but it is too early to talk about easing monetary policy.

On Wednesday, Bailey essentially confirmed his position: he advocated maintaining a wait-and-see stance, noting the effectiveness of the current rate and potential risks to the economy.

On Wednesday, the Construction PMI data for the UK also added pressure on the pound. It came in at 45.6 points against a forecast of 46.3. The indicator has been below the key 50-point mark (indicating contraction) for the third consecutive month.

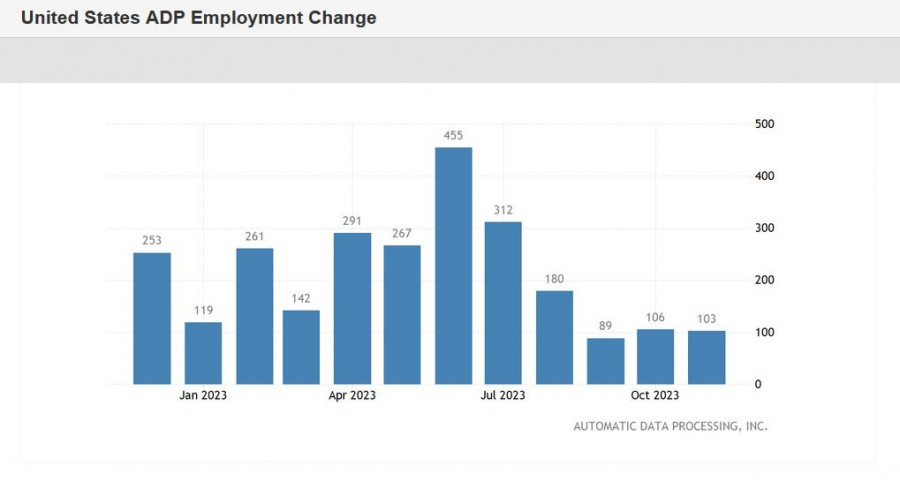

This fundamental background made it possible for the bears to update a one-and-a-half-week price low, but the bearish momentum faded at the start of Wednesday's US session. This time, the dollar suffered, following a weak report from ADP, which reflected a bleak employment picture in the United States. With a forecasted growth of 130,000 non-farm jobs (which is already modest), the indicator came in at 103,000 (compared to the previous month's growth of 106,000).

This is a very worrisome signal for dollar bulls, warning that November's Non-Farm Payrolls, which will be published on Friday, could also end up in the "red zone." Another labor market indicator in the US, the Job Openings and Labor Turnover Survey (JOLTs), showed the weakest result since May 2021. The average labor cost for the third quarter was also revised downward. According to the final reassessment, the indicator decreased to -1.2% (the initial estimate was -0.9%).

The negative news flow for the greenback stopped the bearish momentum, but the situation remains uncertain. In my opinion, you should only consider short positions once the bears have managed to breach the lower line of the Bollinger Bands indicator on the 4-hour chart, which coincides with the 1.2570 level. In this case, the next target will be 1.2500 – the middle line of the Bollinger Bands on the daily chart. However, given the weak ADP and JOLT reports published ahead of the Non-Farms, it is not worth rushing into short positions – at least until the bears have managed to settle below the 1.2570 support level.